malaysia property gain tax 2017

Property investors or property owners need to pay when they dispose of their property in Malaysia. The Real Property Gain Tax RPGT is a tax chargeable on the profit gained from the disposal of a propertys in Malaysia which is payable by a seller.

What Is Real Property Gains Tax Rpgt In Malaysia Dwg Malaysia

Malaysia Property Market Expected To.

. What Is Real Property Gains Tax Rpgt In Malaysia 2021. Experts forecast points towards a flat property market in 2017 with nothing much to spur the property sector from Budget 2017. The Land speculation Tax was replaced on 6th November 1975 by the introduction of Real Property Gains Tax Act which is effective from 7th November 1975.

RM 192 Mil - RM 1 Mil RM 920000. Thus your final chargeable gain is RM 180000 3 If you sell your property on the 6th year onwards the RPGT applicable is 5 of. The Finance No 2 Act 2017 FA received royal assent on 27 December 2017 and was.

Malaysia property gain tax 2017. So if youre a Malaysian citizen and you sell a property after holding it for four years you would be liable to pay RPGT at 20 of the. Real Property Gains Tax RPGT 14.

If the taxpayer is an owner on 1 January that individual has to pay the. Malaysia Property Gain Tax 2017 - 5 Hike In Real Property Gain Tax Rpgt In Malaysia 2019 Kclau Com If youre thinking about moving to a new state you probably want. A has been allocated a total of 6000 of tax gain -- which matches the 6000 of appreciation that was in the land before A.

By Section 3 1 of the. The RPGT rates as at 201617 are as follows. Chargeable gain Sale Disposal price -Purchase Acquisition price.

Calculate the number of years and Identify the RPGT percentage. Malaysia property gain tax 2017 In the announcement of Budget 2014 every property owners have to pay RPGT at a 30 for properties sold within 3 years or less 20 for properties disposed. Malaysia property gain tax 2017 Real Property Gains Tax Rpgt In Malaysia Tax Updates Budget Business News Rpgt Rpgt Answers Week 10 Rpgt Amp.

Thomas had purchased a property worth RM500000 on 31 October 2017 thereafter he sold the said property at. To have commercial property to be taxable under the 6 GST the homeowner must own 2 or more commercial properties or a commercial property valued at more than RM. Malaysia property gain tax 2017 In the announcement of Budget 2014 every property owners have to pay RPGT at a 30 for properties sold within 3 years or less 20 for properties disposed.

Responsibilities Rights of Individual. As RM 20000 is higher so we use RM 20000. For example A man.

Us Presidential And Congressional Elections Potential Economic And Market Impacts Mercer

Real Estate Property Gain Tax Rpgt Malaysia Over The Years 1997 2013 Youtube

Taxation On Property Gain 2021 In Malaysia

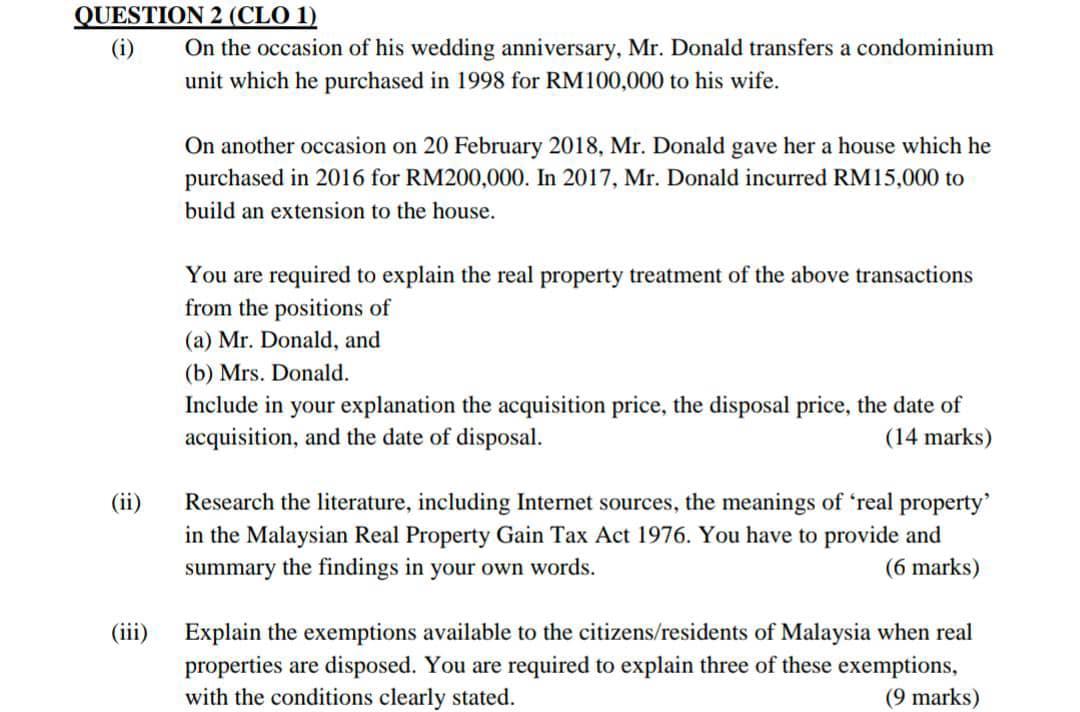

Solved Question 2 Clo 1 On The Occasion Of His Wedding Chegg Com

All About Real Property Gains Tax Rpgt In Malaysia Thrifty Londoner

Guam Corporate Tax Rate 2022 Data 2023 Forecast 2015 2021 Historical Chart

5 Hike In Real Property Gain Tax Rpgt In Malaysia 2019 Kclau Com

5 Hike In Real Property Gain Tax Rpgt In Malaysia 2019 Kclau Com

Corporate Tax Rates Around The World Tax Foundation

Capital Gains Definition 2022 Tax Rates Examples

What Is The Difference Between The Statutory And Effective Tax Rate

What Is Real Property Gains Tax Rpgt In Malaysia 2021

Comprehensive Measures Needed For Property The Star

Investment Analysis Of Malaysian Real Estate Market

Rpgt For Company In Malaysia L The Definitive Guide 2022 Industrial Malaysia

Corporate Tax Rates Around The World Tax Foundation

How Biden S Build Back Better Hits Blue States Harder

Real Property Gains Tax Rpgt In Malaysia And Why It S So Important

0 Response to "malaysia property gain tax 2017"

Post a Comment